pvniax.site

Learn

Currency Mints In Us

The US mint is well-known for producing a wide range of silver, US gold coin, and platinum coins of the highest standards. Their coins, like the Gold American. Many American coins lack a mint mark because in the beginning there was only one mint at Philadelphia. So any coin lacking a mint mark is from the Philadelphia. The Philadelphia Mint has the capacity to produce million coins an hour, 32 million coins per day, and billion coins every year. The U.S. Mint (USM) is responsible for the production and distribution of all coins in the United States. The mint also facilitates the flow of gold and. Official Twitter feed: United States Mint. RT ≠ endorsements. U.S. Mint Privacy Policy: pvniax.site U.S. Currency: The U.S. Mint was founded in and has been producing coins in all denominations ever since. Over the years there have been many rare. The U.S. Mint makes the coins used as money the United States. They also produce special edition coins you can buy for coin collections. The official YouTube channel of the United States Mint. We are the nation's sole manufacturer of legal tender coinage and also produce bullion, collectibles. The United States Mint operates in Philadelphia, Denver, San Francisco, and West Point. Historically, it has also had locations in New Orleans, Carson City. The US mint is well-known for producing a wide range of silver, US gold coin, and platinum coins of the highest standards. Their coins, like the Gold American. Many American coins lack a mint mark because in the beginning there was only one mint at Philadelphia. So any coin lacking a mint mark is from the Philadelphia. The Philadelphia Mint has the capacity to produce million coins an hour, 32 million coins per day, and billion coins every year. The U.S. Mint (USM) is responsible for the production and distribution of all coins in the United States. The mint also facilitates the flow of gold and. Official Twitter feed: United States Mint. RT ≠ endorsements. U.S. Mint Privacy Policy: pvniax.site U.S. Currency: The U.S. Mint was founded in and has been producing coins in all denominations ever since. Over the years there have been many rare. The U.S. Mint makes the coins used as money the United States. They also produce special edition coins you can buy for coin collections. The official YouTube channel of the United States Mint. We are the nation's sole manufacturer of legal tender coinage and also produce bullion, collectibles. The United States Mint operates in Philadelphia, Denver, San Francisco, and West Point. Historically, it has also had locations in New Orleans, Carson City.

Last year, the United States Mint contributed more than $1 billion to the Treasury General fund and produced nearly 15 billion coins. We make money in several. The U.S. Mint in Denver is one of four Mints in the country that produce coins. The other three coin Mints are located in Philadelphia, San Francisco and. Will there be a recall or devaluation of U.S. currency? There will be no recall or devaluation of any current or older-series notes, which will be removed from. The mint played a crucial role in the development of the American economy, providing a stable and reliable source of currency for the growing nation. Its legacy. The four different US Mints that currently strike coins are Philadelphia, Denver, West Point and San Francisco. Learn more about all of the U.S. Mints. Authorized by Congress in , U.S. Mint's history in Philadelphia has intertwined with the complicated history of the American currency system. The U.S. Mint in Denver is one of four Mints in the country that produce coins. The other three coin Mints are located in Philadelphia, San Francisco and. American Mint offers coins for collectors at fair prices: exclusive commemoratives ✓ silver, gold & platinum coins ✓ U.S. currencies ✓ collectors' knives. There have been eight coinage mints in operation at various times in the United States. Of these, only four were active in the late 20th century. The mint in. Foreign Coins Struck at US Mints · Australia, S, 1 Shilling, MS63 · Cuba, , ABC Peso, MS63, NGC · Cuba, 20 Centavos, MS60 · Hawaii, , 25 Cents. The United States Mint is largest mint manufacturer in the world, operating across six sites and producing as many as 28 billion coins in a single year. A mint is the primary producer of a country's coin currency and has the approval of the government to manufacture coins to be used as legal tender. By , the United States Mint began operating a branch mint in New Orleans to mint silver and gold coins. Also coming online in were two branch. The Federal Reserve has its representatives: there are 12 Federal Reserve banks around the US. These banks are non-state as well, and each of these banks is. The mint played a crucial role in the development of the American economy, providing a stable and reliable source of currency for the growing nation. Its legacy. Currency and Coins. U.S currency is produced by the Bureau of Engraving and Printing and U.S. coins are produced by the U.S. Mint. Both organizations are. Four US Mint facilities are presently striking coins for circulation in the United States | Find more information at Austin Rare Coin & Bullion. US Mint Sets are specially packaged collections of coins produced by the United States Mint. These sets, produced particularly for collectors, are issued. Before the mint was quite ready, the first official American silver coin, the half dime, was struck in October in John Harper's cellar a short distance. It mints circulation coins for the United Kingdom and produces coins for more than 60 countries around the world, including New Zealand and many Caribbean.

How Much Should I Spend On Myself

Set a personal payment goal. Expand · Determine how much of your monthly salary you need to set aside to meet your financial goals. Saving for retirement and. The best way to save money at age 21 is to start practicing the 50/30/20 rule: When you get paid, spend 50% for needs, 30% for wants, and 20% for savings or. Follow our 50/15/5 Rule: No more than 50% of your take home pay should go to essential expenses, 15% to retirement savings, and 5% to short-term savings. Careful spending is where financial health begins. See how to help smooth out your spending habits, pay bills on time, and increase your ability to save. Adding up your purchases can help you to see exactly how much you're compulsively spending. Our spending feature in the Barclays app shows you where your money. Without one, you're more likely to find yourself in the dark about your financial health and lost in the wilderness of debt and financial insecurity. Is it any. If your salary is high (more than 50–60k/person/month) then save more than 20%. 20% should be a minimum target, not a maximum one. The 50 30 20 rule is a simple budgeting method, which you can use to plan out how much you should spend and save each month. 50% of your income on needs: essential living expenses, such as rent/mortgage, bills, food, and transport to work · 30% on wants: discretionary spending, such as. Set a personal payment goal. Expand · Determine how much of your monthly salary you need to set aside to meet your financial goals. Saving for retirement and. The best way to save money at age 21 is to start practicing the 50/30/20 rule: When you get paid, spend 50% for needs, 30% for wants, and 20% for savings or. Follow our 50/15/5 Rule: No more than 50% of your take home pay should go to essential expenses, 15% to retirement savings, and 5% to short-term savings. Careful spending is where financial health begins. See how to help smooth out your spending habits, pay bills on time, and increase your ability to save. Adding up your purchases can help you to see exactly how much you're compulsively spending. Our spending feature in the Barclays app shows you where your money. Without one, you're more likely to find yourself in the dark about your financial health and lost in the wilderness of debt and financial insecurity. Is it any. If your salary is high (more than 50–60k/person/month) then save more than 20%. 20% should be a minimum target, not a maximum one. The 50 30 20 rule is a simple budgeting method, which you can use to plan out how much you should spend and save each month. 50% of your income on needs: essential living expenses, such as rent/mortgage, bills, food, and transport to work · 30% on wants: discretionary spending, such as.

How much should I save each week or month? · 50% of your salary is for your basic living expenses like housing, food and power bills · 30% is for your wants like. how much time you spend on it. Find ways to delay purchasing. You could tell yourself, "I will buy this tomorrow if I still feel like it then". You could. If you have to spend over 30% per month on rent, you'll have less money left over for bills and important purchases, making it more difficult to build savings. This is the step where you really get into how to budget your money. Tally your monthly income and monthly expenses. Compare those two columns. You should have. The standard rule of thumb is to save 20% from every paycheck. This goes back to a popular budgeting rule that's referred to as the strategy. Make a budget, and stick to it. Financial success refers not so much to earning money as it does to making wise choices about how to use your money. This calculator uses the 50/30/20 budget to suggest how much of your monthly income to allocate to needs, wants and savings. Some experts say you should invest 10% to 20%. Here's how to determine the right amount for your budget. While it's tempting to spend it, saving all or a portion of that money could help you quickly set up your emergency fund. Again, you can determine how much. how you spend your money. Why do I want a budget? A budget helps you decide: what you must spend your money on; if you can. Estimate how much you spend on these each month. Looking at past Budgets should be adjusted over time. Ask yourself, “Am I spending and saving my money. How to use the 50/30/20 rule to budget your money · Spend 50% of your income on 'needs' · Spend 30% of your income on 'wants' · Put 20% of your income into savings. If it's not something you need, take a week to think on it. Does this purchase come with a payment plan (e.g. a car loan) that will mess with your budget? Will. If that's within your budget, you've paid your bills and you've paid yourself, go for it. Our retirement calculator can help you figure out how much you. Set a personal payment goal. Expand · Determine how much of your monthly salary you need to set aside to meet your financial goals. Saving for retirement and. Include “Savings” as a fixed expense in your monthly budget. Pay yourself first every month! Your savings can be used as an emergency fund to help you deal with. Protect yourself from scams · Online shopping · Identity theft · Using This money could be from your wages, pension, government benefit or payment. The first step to start saving money is figuring out how much you spend. Your budget should show what your expenses are relative to your income, so. The 50 30 20 rule is a simple budgeting method, which you can use to plan out how much you should spend and save each month. Be fair on yourself.

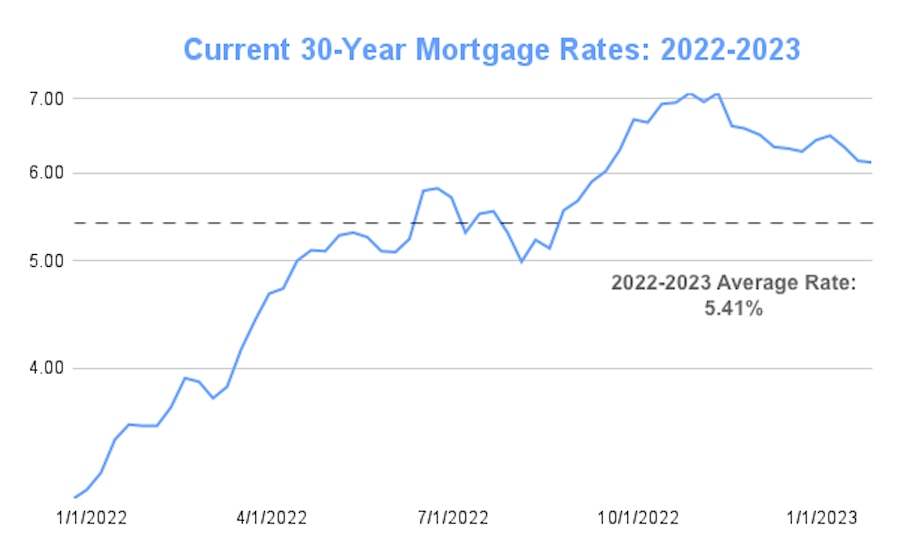

What Is The Going Mortgage Rate Right Now

Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. View current and personalized mortgage rates and explore the benefits of financing your home with PNC. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Apply Now*. Still have some questions? Our team of mortgage experts at Citizens is committed to helping customers find the home loan solution that's right for. The mortgage rate roller coaster took a thrilling plunge, declining to its lowest level in nearly 15 months and dipping below % for the first time in. Today's Locked Mortgage Rates ; YR. CONFORMING. % − ; YR. CONFORMING. % − ; YR. JUMBO. % − ; YR. FHA. % − The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Current mortgage interest rate trends Mortgage rates sit at their lowest level since February The average year fixed rate dropped from % Sept. 5. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 1 basis point from % to % on Tuesday. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. View current and personalized mortgage rates and explore the benefits of financing your home with PNC. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Apply Now*. Still have some questions? Our team of mortgage experts at Citizens is committed to helping customers find the home loan solution that's right for. The mortgage rate roller coaster took a thrilling plunge, declining to its lowest level in nearly 15 months and dipping below % for the first time in. Today's Locked Mortgage Rates ; YR. CONFORMING. % − ; YR. CONFORMING. % − ; YR. JUMBO. % − ; YR. FHA. % − The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Current mortgage interest rate trends Mortgage rates sit at their lowest level since February The average year fixed rate dropped from % Sept. 5. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 1 basis point from % to % on Tuesday.

Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. Get information on current mortgage refinance rates. Mountain America has You won't have to worry about rates going up between making an offer and closing on. Current mortgage rates: How high are average mortgage rates right now? Mortgage rates ping-ponged in May, starting at %, falling to %, and then. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Customized mortgage rates ; year fixed, % (%), $ credit to closing costs, $2, ; year fixed, % (%), $77 added to closing costs. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 11 pm EST. Adjustable-Rate Mortgage ; Taxes and insurance not included; therefore, the actual payment obligation will be greater. ; % · Taxes and insurance not included;. What is the current mortgage rate? Your actual rate may vary based on your financial profile. Get a personalized quote with no impact to your credit score in. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. On Thursday, Sept. 12, , the average interest rate on a year fixed-rate mortgage rose eight basis points to % APR. The average rate on. Current Mortgage Rates Data Since xlsx. Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac's economists. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. National average rates. The best way to get your current mortgage rate is to let us estimate it based on your unique details. When Will Mortgage Rates Go Down? Read The. Use our mortgage calculator to get a customized rate and payment estimate. For our current refinancing rates, go to mortgage refinance rates. N/A. Mortgage. September mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current. What is the current interest rate for a reverse mortgage? Presently, the lowest fixed interest rate on a fixed reverse mortgage is % (% APR), and. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These.

Capital One Venture Rewards Card Review

Cardholders can transfer points to plus transfer partners and use miles to pay for travel purchases. Read the full review. Pros. Solid welcome offer of. The Capital One Venture Rewards Credit Card is a really good travel rewards card for the frequent traveler. You can earn tons of miles and use them in many. The Capital One Venture Rewards Credit Card is one of the best travel credit cards on the market, primarily because of its 2 miles per dollar rewards rate. The Capital One VentureOne Rewards Credit Card is the go-to for those who crave simplicity and value in their travel reward card. With no annual fees, a steady. The Capital One VentureOne Rewards Credit Card is the go-to for those who crave simplicity and value in their travel reward card. With no annual fees, a steady. The Capital One Venture Rewards Credit Card makes for a unique one-card solution in that it offers the best of both worlds: earn 2x “miles” on all purchases and. Some blasted customer service (honestly doesn't everyone complain about that with ANY company) and others cited disappointing credit limits/. The Capital One VentureOne Rewards Credit Card is a solid choice for earning unlimited travel rewards that can transfer to partners without paying an annual. Capital One VentureOne Review Highlights · Good rewards for light-spenders · Above-average 0% promotion · Transfer fee: 3% for the first 15 months, 4% at a promo. Cardholders can transfer points to plus transfer partners and use miles to pay for travel purchases. Read the full review. Pros. Solid welcome offer of. The Capital One Venture Rewards Credit Card is a really good travel rewards card for the frequent traveler. You can earn tons of miles and use them in many. The Capital One Venture Rewards Credit Card is one of the best travel credit cards on the market, primarily because of its 2 miles per dollar rewards rate. The Capital One VentureOne Rewards Credit Card is the go-to for those who crave simplicity and value in their travel reward card. With no annual fees, a steady. The Capital One VentureOne Rewards Credit Card is the go-to for those who crave simplicity and value in their travel reward card. With no annual fees, a steady. The Capital One Venture Rewards Credit Card makes for a unique one-card solution in that it offers the best of both worlds: earn 2x “miles” on all purchases and. Some blasted customer service (honestly doesn't everyone complain about that with ANY company) and others cited disappointing credit limits/. The Capital One VentureOne Rewards Credit Card is a solid choice for earning unlimited travel rewards that can transfer to partners without paying an annual. Capital One VentureOne Review Highlights · Good rewards for light-spenders · Above-average 0% promotion · Transfer fee: 3% for the first 15 months, 4% at a promo.

The Capital One Venture Rewards and Capital One Venture X cards both provide rental car coverage. The only difference is the Venture card's MasterRental. Capital One Venture Review: Is it worth the annual fee? We crunch the numbers on this travel credit card, including its bonus miles. Annual fee: $ Rewards: 5 miles per $1 on hotels, vacation rentals and rental cars booked through Capital One Travel and purchases through Capital One. Capital One Venture Rewards calculator. Ask Sebby crunches the numbers for you to calculate the Expected Value of the Capital One Venture Rewards card. For the. The Capital One Venture Rewards Credit Card (rates & fees) provides generous miles rewards to those with excellent credit who are willing to fork over an. The Capital One VentureOne Rewards credit card offers a mile signup bonus and up to 5x miles per $1 spent. Find details in our review. The Capital One Venture Rewards Credit Card is a great travel credit card that can also earn you cashback even when you have no travel plans. It offers a higher. Decent sign-up bonus The Capital One VentureOne Rewards Credit Card offers 20, bonus miles after spending $ on purchases in the first 3 months after the. The Capital One Venture Rewards Credit Card is a really good travel rewards card for the frequent traveler. You can earn tons of miles and use them in many. Platinum Mastercard® product image · Platinum Mastercard® · 9, reviews ; Venture X Rewards product image · Venture X Rewards · reviews ; Venture Rewards. Not only does it earn 2x points on any purchases, but it has a low annual fee and a high welcome offer. But redeeming points is where this card shines, since. No complaints here. Very happy with card. Customer service is awesome. Has really helpe me with my credit journey. Yes, I recommend this product. Capital One Venture Rewards Credit Card gives you 2 miles for every dollar spent. You can easily accumulate miles to go on your next vacation with this high. The Capital One Venture Rewards Credit Card is a solid mid-tier travel card that earns at least 2x miles on every purchase, redeemable rewards for travel, cash. The Capital One Venture Rewards Credit Card is one of the most well-known cards in the travel space. Capital One recently introduced more than a dozen transfer. Decent sign-up bonus The Capital One VentureOne Rewards Credit Card offers 20, bonus miles after spending $ on purchases in the first 3 months after the. Capital One Venture Rewards calculator. Ask Sebby crunches the numbers for you to calculate the Expected Value of the Capital One Venture Rewards card. For the. This card is best for casual or beginner travelers who want an easy way to earn travel rewards on everyday purchases without paying an annual fee. The Capital One VentureOne Rewards Credit Card offers a simple rewards program with Miles per dollar on every purchase, every day. And, your miles don't expire as long as your account is open. Customer Reviews & Redemptions. WRITE A REVIEW. Megan C.

How Much Does Online Couples Therapy Cost

For out of pocket I charge anywhere from $$ per 50 minute session. However, I have been told I greatly undercharge as the typical rate is. We do have a few appointments available at a reduced rate for couples who do not have out-of-network coverage. Is there a difference in price between online. On average, couples counseling can cost anywhere from $75 to $ or more per session, with some therapists charging higher rates in urban areas. Fees ; minute session = $ minute session = $ · = $ 2-hour Discernment session = $ ; min session = $ min session = $ · = $ 2-hour. Counselling for Couples in South Dublin and Online. How much does it cost for couples counselling? Prices for Couples Therapy vary. My fee is set at a. Online therapy costs between $50 and $/week, depending on the practitioners' employment status. Independent counselors typically charge between $75 and $/. Affordable access to stronger bonds: BetterHelp's couples therapy bridges the gap, with prices starting at $65/week. Rates for individual counseling and couples counseling sessions vary from $$ for one minute session (a "therapeutic hour"), with an exception. A low of $60 and a high of $ is typical. My rate for Elk River, St. Cloud, and online in MN is $ - $, based on client income. Most marriage counselors. For out of pocket I charge anywhere from $$ per 50 minute session. However, I have been told I greatly undercharge as the typical rate is. We do have a few appointments available at a reduced rate for couples who do not have out-of-network coverage. Is there a difference in price between online. On average, couples counseling can cost anywhere from $75 to $ or more per session, with some therapists charging higher rates in urban areas. Fees ; minute session = $ minute session = $ · = $ 2-hour Discernment session = $ ; min session = $ min session = $ · = $ 2-hour. Counselling for Couples in South Dublin and Online. How much does it cost for couples counselling? Prices for Couples Therapy vary. My fee is set at a. Online therapy costs between $50 and $/week, depending on the practitioners' employment status. Independent counselors typically charge between $75 and $/. Affordable access to stronger bonds: BetterHelp's couples therapy bridges the gap, with prices starting at $65/week. Rates for individual counseling and couples counseling sessions vary from $$ for one minute session (a "therapeutic hour"), with an exception. A low of $60 and a high of $ is typical. My rate for Elk River, St. Cloud, and online in MN is $ - $, based on client income. Most marriage counselors.

Seeking marriage or couples counseling in Columbus, Ohio and want to know how much it will cost? Here are some answers to the most frequently asked. Cost Per Session · Initial Couples Therapy Session (minute) - $ · Individual, Family & Couple Session (minute) - $ · Couples Intensive Therapy. In the United States, the average cost of a couple's counseling session is $ to $ per hour. ReGain is far less expensive with costs averaging about $ $ or $ for the initial session, depending on length and associate. Fees after the first session vary by associate. $/ for a standard minute. $69 a week to message a therapist isn't a lot, but the cost can be up to $ a week if not more. In using traditional/in-person mental health services with my. Find a therapy services Fees for couples, individuals, and families in Denver then just click here to check our counselor fee structure. Call today! Our therapists are here to help. Learn more about fees, our availability, and use our online scheduler to schedule your first appointment. How much is couples therapy in Texas? ; City, Average Cost per Session ; Houston, $ – $ ; Dallas, $ – $ ; Austin, $ – $ ; San Antonio, $ – $ The lowest any of our couples therapists will slide down to is $ per 1 hour session. Once again, the ability to slide is dependent upon that counselor's. We have a range of fees based on clinician experience levels, ranging from $ - per 45 minute individual session or 80 minute couples session. On average, the couples counseling cost can range from approximately $50 to $ per session. Some health insurance plans may cover couples therapy, and many. BetterHelp has over 30, licensed therapists who provide convenient and affordable online therapy. BetterHelp starts at $65 per week. Complete a brief. In the San Francisco Bay Area, couples therapy ranges from $ per therapy hour to $ per therapy hour. Why the wide range? Some therapists are in high. The service works with several insurance providers, but even if you don't have insurance, you can still access low-cost therapy for $80 per session. LiveHealth. How Long Do Marriage Counseling Sessions Last? For marriage counseling, a one hour time constraint can be very limiting. Couples therapy sessions can often take. In general, couples counseling costs between $ per hour. Given that most professional couples counselors offer minute sessions for couples, that means. How does online couples therapy work? · Is online couples therapy right for me? · Can an online couples therapist meet with each partner separately? · What should. Couples therapy costs vary based on insurance, therapist's credentials, experience, and location. The average cost of couples therapy in New Jersey is anywhere. Generally, couples therapy sessions can cost anywhere between $$ But several things can influence couples counseling costs, from location to therapy type. If you want a price range, a minute couples or marriage counseling session in San Diego costs from $ to $, with an average session costing around.

Cost Of Mortgage Per Month

Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. It will quickly estimate the monthly payment based on the home price (less downpayment), the loan term and the interest rate. There are also optional fields. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. If you have to pay an interest rate of % instead of % on your loan, your monthly payment will cost $ more. The total cost of your mortgage will also. Mortgage costs may vary depending on where you live. In California, the average monthly mortgage payment is $1, That said, actual prices will differ per. If you have to pay an interest rate of % instead of % on your loan, your monthly payment will cost $ more. The total cost of your mortgage will also. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. Closing costs can include: Outstanding mortgages and liens on the property. Seller's agent commission. Buyer's agent commission. Excise tax. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. It will quickly estimate the monthly payment based on the home price (less downpayment), the loan term and the interest rate. There are also optional fields. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. If you have to pay an interest rate of % instead of % on your loan, your monthly payment will cost $ more. The total cost of your mortgage will also. Mortgage costs may vary depending on where you live. In California, the average monthly mortgage payment is $1, That said, actual prices will differ per. If you have to pay an interest rate of % instead of % on your loan, your monthly payment will cost $ more. The total cost of your mortgage will also. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. Closing costs can include: Outstanding mortgages and liens on the property. Seller's agent commission. Buyer's agent commission. Excise tax. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes.

What's included in a mortgage payment? Your mortgage payment consists of four costs, which loan officers refer to as 'PITI.' These four parts are principal. This mortgage calculator uses your loan amount, interest rate, and an optional deposit, to give an idea of your monthly mortgage repayments. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments You'll get a low rate, custom terms, and a fast closing. A monthly mortgage payment is made up of many different costs. Our mortgage calculator's payment breakdown can show you exactly where your estimated payment. What Is the Monthly Payment of a $, Mortgage? A mortgage of $, will cost you $3, per month in interest and principal for a year loan. To Consider Other Home-Buying Finance. From mortgage closing costs to a reserve fund for home repairs, there are other expenses associated with buying a home. i = period interest rate expressed as a decimal; n = number of mortgage payments. Example. Suppose you wish to acquire a home that costs. Given this information, you can afford between $3, - $3, per month. The 35% / 45% model gives you more money to spend on your monthly mortgage payments. Our calculator can help you hone in on an affordable monthly mortgage payment — including all the extra costs. Then, you can begin to budget accordingly. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. If you take out a year fixed rate mortgage, this means: n = 30 years x 12 months per year, or payments. Our simple mortgage calculator with taxes and. Most experts recommend that your monthly mortgage payment should not exceed 35% of your gross income. But that is the upper end. Other models are more. Total number of "points" purchased to reduce your mortgage's interest rate. Each 'point' costs 1% of your loan amount. As long as the points paid are not a. This concept also applies to businesses, especially concerning fixed costs and shutdown points. Key Takeaways. Mortgage payments are made up of your principal. monthly payments and rate options for a variety of loan terms. Get a breakdown of estimated costs including property taxes, insurance and PMI. For example, let's say that John wants to purchase a house that costs $, and has saved up a $25, down payment. His loan amount (A) is $,, the. 28% of your gross monthly income on home-related costs and 36% on total debts, including your mortgage, credit cards and other loans like auto and student loans. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. The total cost of home ownership is more than just mortgage payments. Additional monthly costs include homeowner's insurance, property taxes, Home Owners.

Bachelor Of Science In Computer Applications

Choose from any one of our diverse specialty streams and gain expertise in programming, algorithms, software engineering, databases and web applications. Students acquire a strong foundation in computer science for careers in the professional workforce, academic research, and entrepreneurship. Courses are. As a computer science graduate, you'll be prepared for career opportunities in areas such as the civil service, the non-profit sector, and the business world. Most people would immediately think of software development, others might say gaming development. However, a degree in computer science could take you into many. Most programs consist of fundamental computer application topics, such as database design and usage, word processing programs and spreadsheets. The Bachelor of Science in Computer Science is a program for students to study computers, computer software and computation systems including their theory. This program will build the skills you need to develop and run computer-based systems in business, education, and other fields that process, use and manage. You can take specialized courses in object-orientation, computer graphics, intelligent systems, computer networks, advanced Internet, neural networks, computer. Earn a degree in Computer Science from one of the world's top computer science schools. Graduate with up to 2 years of paid work experience. Choose from any one of our diverse specialty streams and gain expertise in programming, algorithms, software engineering, databases and web applications. Students acquire a strong foundation in computer science for careers in the professional workforce, academic research, and entrepreneurship. Courses are. As a computer science graduate, you'll be prepared for career opportunities in areas such as the civil service, the non-profit sector, and the business world. Most people would immediately think of software development, others might say gaming development. However, a degree in computer science could take you into many. Most programs consist of fundamental computer application topics, such as database design and usage, word processing programs and spreadsheets. The Bachelor of Science in Computer Science is a program for students to study computers, computer software and computation systems including their theory. This program will build the skills you need to develop and run computer-based systems in business, education, and other fields that process, use and manage. You can take specialized courses in object-orientation, computer graphics, intelligent systems, computer networks, advanced Internet, neural networks, computer. Earn a degree in Computer Science from one of the world's top computer science schools. Graduate with up to 2 years of paid work experience.

Computer science deals with the theoretical foundations of information and computation, and with practical techniques for their implementation and. Introductory computer science courses offer an overview of programming skills, the use and application of popular software, and the essentials of computing. The Bachelor of Science in Computer Science (BSCS) degree program is an interdisciplinary program with an emphasis on the various disciplines within the. With the theoretical foundation built into the program, computer science graduates can excel in system and software development, as well as in designing. In this program you will blend foundational knowledge and technical skills to explore intriguing topics such as computer systems that mimic human vision or mine. The Computer Science bachelor's program is offered % online or on campus. Whether you are a traditional student or a working professional, this flexible. The Bachelor of Science in Computer Science Program is accredited by the Computing Accreditation Commission of ABET, pvniax.site A Bachelor of Computer Science degree takes a minimum of three or four years (90 – credits) of full-time study, depending on your academic background. The. Successful completion of this program provides students with opportunities to complete the remainder of their undergraduate degree in top ranking Universities. What You Will Learn · Software Design and Management · Computer Programming and Support · Networking and Information Security · Data Analysis, Data Mining, and. BCS degrees are typically about three years and are computer applications degree that focuses on developing websites, apps, software, mobile platforms. pvniax.site Computer Applications is a 3-year full-time undergraduate degree program dealing with the study related to the various aspects of computer functioning. As a Computer Science student, you will learn about the ways in which computers and software aid, inform and enrich our lives and gain a strong theoretical. The Bachelor of Science in Computer Science program at Embry‑Riddle prepares students to emerge with a solid foundation in computer science basics, advanced. Bachelor of Science in Software Systems Development In this program, you will gain knowledge and skills in developing large software systems. This program is. Computer Science (BSc) Solve problems, innovate and make life better through technology. From applied cryptography to mobile computing, computer science will. Gain in-demand skills to join one of the fastest growing fields in the world and learn the latest in programming, software, and computing technology. In this program, you'll obtain a deep understanding of computers, the inner workings of software and the application of computer technology to real-world. Get a well-rounded education that prepares you for a career that's in high demand. The computer science major pairs computing with areas that interest you, such. The B.S. in Computer Science gives you the broad computational thinking, programming, and problem-solving skills you'll need to succeed as a computing.

How Do I Turn Off Overdraft Protection Bank Of America

A reserve line account must be closed to remove its link as an overdraft protection account. · If you have a credit account linked for overdraft protection. If you do opt-in for overdraft protection or coverage, then your bank Consumer Financial Protection Bureau (CFPB) New insights on bank overdraft fees and 4. Balance Connect for overdraft protection allows you to link your eligible checking account with up to 5 eligible Bank of America accounts for overdraft. We're here to lower the cost of “oops” moments with overdraft protection for your Premier America Credit Union checking account in CA and TX. Learn more. How Does Hour Grace work on overdrafts and returns? *If you choose Overdraft Privilege Plus, ATM withdrawals and everyday debit card transactions will be included with the transactions listed under Overdraft. An overdraft happens when your checking account does not have enough funds to cover a purchase or payment. Discover how you can help avoid overdraft fees. Log into TD Online Banking. Select Account Options > Bank Account Statement Settings. Select applicable account from Eligible Accounts dropdown. Click on. You activate an overdraft facility when a check is presented for payment for an amount greater than the amount in your checking account. A reserve line account must be closed to remove its link as an overdraft protection account. · If you have a credit account linked for overdraft protection. If you do opt-in for overdraft protection or coverage, then your bank Consumer Financial Protection Bureau (CFPB) New insights on bank overdraft fees and 4. Balance Connect for overdraft protection allows you to link your eligible checking account with up to 5 eligible Bank of America accounts for overdraft. We're here to lower the cost of “oops” moments with overdraft protection for your Premier America Credit Union checking account in CA and TX. Learn more. How Does Hour Grace work on overdrafts and returns? *If you choose Overdraft Privilege Plus, ATM withdrawals and everyday debit card transactions will be included with the transactions listed under Overdraft. An overdraft happens when your checking account does not have enough funds to cover a purchase or payment. Discover how you can help avoid overdraft fees. Log into TD Online Banking. Select Account Options > Bank Account Statement Settings. Select applicable account from Eligible Accounts dropdown. Click on. You activate an overdraft facility when a check is presented for payment for an amount greater than the amount in your checking account.

Log in to BMO Digital Banking and modify your overdraft preferences within the "Account preferences" section · Use the BMO Bank by Phone self-serve option by. To sign up for Overdraft Protection, please stop by our branch office or contact Customer Service at West Tilghman St Allentown. on recent deposits and any pending transactions that are known to the Bank. Overdraft fees are not applicable to Clear Access Banking accounts. The. For consumer accounts only, if you also want us to authorize and pay overdrafts on one-time debit card transactions and ATM withdrawals, stop by any of our. Balance Connect® for overdraft protection can help you cover purchases and payments. Learn more about what it is, how it works, and enroll today. If we pay an item that results in an overdraft on your account based on the America only. Back to Top. +. LEAVING SIMMONS BANK. You are leaving the. Standard Overdraft Practices. When an overdraft happens, our standard practice is to try to honor (or pay) the item rather than returning it unpaid. Your decision to revoke your consent does not require that the bank waive or reverse any overdraft fees already assessed on your account, but it will prevent. Courtesy Pay can be terminated any time for abuse, including regularly exceeding the overdraft limit. We will charge a $ fee each time an overdraft. For instance, the Bank of America Advantage Plus Banking® account does not bank account, consider switching to an account that has no overdraft fees. Under Bank Account Services on the main menu, select Overdraft Coverage Preferences. · In the checkbox next to your preferred account, select Opt-In or Opt-Out. Overdraft Protection transfers from your credit card are Bank Cash Advances No fee on standard styles and discounts on certain styles. Card. • On ACH Keep in mind, regardless of your overdraft setting, if you set up Balance Connect® for overdraft protection,2 we'll automatically. To cancel (opt-out) of Privilege Pay, submit your request by phone, in person at any branch, or by secure email. We Are Here To Help. Connect With Our Staff. Overdraft protection is an optional bank account service that prevents the For example, the U.S. Senate held hearings on how and why banks charge fees. For instance, the Bank of America Advantage Plus Banking® account does not bank account, consider switching to an account that has no overdraft fees. Online banking: Select your checking account and choose Account services. · Select Overdraft resources, then choose Overdraft coverage. · Choose Change coverage. Call our Customer Care Center at There Are Other Overdraft Management Solutions: Ameris Bank offers overdraft protection plans which may be less. Set up Overdraft Protection by signing on to the Wells Fargo Credit Card Service Center and selecting Overdraft Protection, calling a Phone Banker at Bounce Protection is automatically included with most checking accounts. You can ask for the coverage to be removed by calling () or stopping by a.

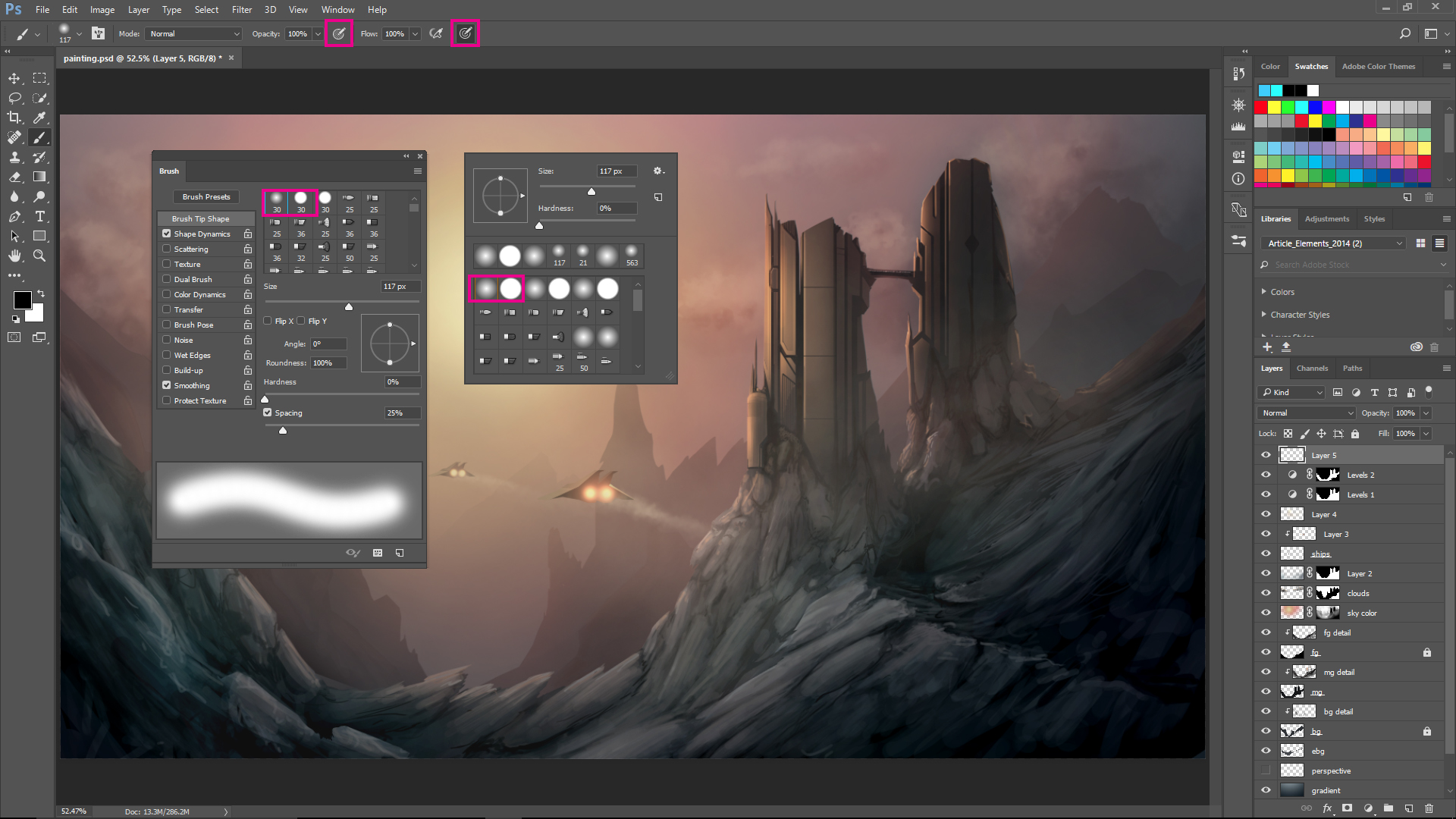

How To Create Digital Drawings

This is a tutorial about the first steps to creating digital art. These steps have nothing to do with making the actual art. Tablets make it easy to start drawing digitally! All you need is a drawing app and a tablet stylus to get going. This article introduces ways to create digital art including: Mathematical, Kaleidoscope and Tessellation, Vector, Pixel, Voxel, 3D and Digital Painting. Whenever I make significant changes to my drawing, I'll start on a new layer, which I can click on and off to see if the drawing is improving. I feel it's. With a single click, create a digital painting, graphic novel panel, cross-hatch sketch, and more. If you want to unleash your inner artist and create digital. Apple's tablet has a huge selection of applications specifically designed for creating digital art. Check out the link above for some of our favorites. To make digital art, you'll need a computer, a program that allows for digital drawing, and a tablet. Easily create amazing digital art drawings in seconds with the Fotor's digital art maker. Based on Fotor's Powerful AI technology, you can create unique NFT. With a single click, create a digital painting, graphic novel panel, cross-hatch sketch, and more. If you want to unleash your inner artist and create digital. This is a tutorial about the first steps to creating digital art. These steps have nothing to do with making the actual art. Tablets make it easy to start drawing digitally! All you need is a drawing app and a tablet stylus to get going. This article introduces ways to create digital art including: Mathematical, Kaleidoscope and Tessellation, Vector, Pixel, Voxel, 3D and Digital Painting. Whenever I make significant changes to my drawing, I'll start on a new layer, which I can click on and off to see if the drawing is improving. I feel it's. With a single click, create a digital painting, graphic novel panel, cross-hatch sketch, and more. If you want to unleash your inner artist and create digital. Apple's tablet has a huge selection of applications specifically designed for creating digital art. Check out the link above for some of our favorites. To make digital art, you'll need a computer, a program that allows for digital drawing, and a tablet. Easily create amazing digital art drawings in seconds with the Fotor's digital art maker. Based on Fotor's Powerful AI technology, you can create unique NFT. With a single click, create a digital painting, graphic novel panel, cross-hatch sketch, and more. If you want to unleash your inner artist and create digital.

The artist uses painting and drawing techniques with a stylus that comes with the graphics tablet to create drawings/paintings within a digital art software. Learn the basics of digital art, from the tools you need to the steps of creating digital artwork. This article introduces ways to create digital art including: Mathematical, Kaleidoscope and Tessellation, Vector, Pixel, Voxel, 3D and Digital Painting. To make digital art, you'll need a computer, a program that allows for digital drawing, and a tablet. The best way to practice is to draw everyday. Start by learning the fundamentals of drawing. Learn gesture, proportions, landmarks of the human figure. Do some pen scetches and some digital art. What works best for me is using multiple techniques. I do pencil drawings, sepia drawings, big acrylic paintings, I. Sketchbook is a great and simple-to-use option for beginning digital doodlers. It is available on Android and iOS devices, so you can find it in either the. 4 Websites Where Kids Can Create Digital Art. Blend fun with learning using these creative sites and apps with your kids. Most people start their digital art creation process with what they like to create. Not really an entirely bad idea since a big part of staying creative is. This step by step video tutorial of a 1/2 cartoon digital portrait is a great activity to develop your skills. Do some pen scetches and some digital art. What works best for me is using multiple techniques. I do pencil drawings, sepia drawings, big acrylic paintings, I. There are many different ways to make digital art. These include everything from software and online programmes that let you paint and draw, like Adobe. The first step in creating digital art is choosing the software that you'll use. There are many different software options available, including Adobe Photoshop. I try to make some good Graphic Design Artworks, Time-lapse | Speed Art videos, Design Application Tips, Product Review & Tutorials in Adobe Illustrator. You can create art using a digital art program on a computer, tablet or smartphone. You can use your finger like a pen or paint brush on the screen. Adobe Photoshop: The industry standard for digital art and image editing, offering a vast array of tools, brushes, and filters for professional. From a Udemy Digital Art student · Create atmospheric digital art from your pencil sketch · How to Draw and Paint on the iPad with the Procreate App · Learn How to. Why is digital illustration important? · 1. Choose a digital art software · 2. Create a sketch · 3. Design on several layers · 4. Draw with colors · 5. Delete. A device to draw on. This could be a computer or laptop, tablet, or smartphone. · A stylus. Swap your HB pencil for a sleek stylus to make drawing on your. I compose on the computer with Adobe PhotoShop. Then I create a layer and trace just the outline of the drawing on that layer. I print just the outline on.

Choosing An Investment Advisor

The planner's job is to help you develop a workable financial plan that zeroes in on personal goals. Here are some tips on finding and consulting a financial. Financial advisors are like tour guides, pinpointing where you want to go financially and helping you get from point A to point B. Whether your destination. A vital step in selecting an investment professional is to see if the individual and their firm are registered. BrokerCheck is a good place to start when. It's also a good idea to choose an advisor who has real-life experience in investing, as this can provide valuable insights. Another important. Your style and your needs should drive your decision in choosing a financial advisor. Follow these steps to help find the one who's a good fit for you. Choosing the right financial advisor requires a holistic approach that not only considers his or her track record but also how you feel about working with this. I have interviewed a few financial advisors, including few working on their own and investing through fidelity and Schwab. I also spoke with local Schwab. A true financial advisor should be a well-educated, credentialed, experienced, financial professional who works on behalf of their clients. Should be a fee-only financial advisor. 2. Should be a good patient listener. 3. Should have experience in as many market cycles as possible. 4. The planner's job is to help you develop a workable financial plan that zeroes in on personal goals. Here are some tips on finding and consulting a financial. Financial advisors are like tour guides, pinpointing where you want to go financially and helping you get from point A to point B. Whether your destination. A vital step in selecting an investment professional is to see if the individual and their firm are registered. BrokerCheck is a good place to start when. It's also a good idea to choose an advisor who has real-life experience in investing, as this can provide valuable insights. Another important. Your style and your needs should drive your decision in choosing a financial advisor. Follow these steps to help find the one who's a good fit for you. Choosing the right financial advisor requires a holistic approach that not only considers his or her track record but also how you feel about working with this. I have interviewed a few financial advisors, including few working on their own and investing through fidelity and Schwab. I also spoke with local Schwab. A true financial advisor should be a well-educated, credentialed, experienced, financial professional who works on behalf of their clients. Should be a fee-only financial advisor. 2. Should be a good patient listener. 3. Should have experience in as many market cycles as possible. 4.

Research and compare your options before choosing an advisor to meet with and scheduling a call. Contact our team if you need any help. For most firms, the advisor's primary job is to “close” the client; the client's money is invested according to a predetermined model, and the advisor then. In selecting an Investment Advisor it is important for you to know the legal relationship the person operates under; a professional broker – “suitability”. What goes into choosing a financial planner? Visit Citizens for five questions to consider, from their investment approach, and accreditation to your. If an adviser is paid by salary, the cost of their advice is built into the products you buy. Many advisers are paid a commission for every product they sell. Download the full booklet for information about choosing a financial adviser and making the most of the relationship. Here are some key questions you can answer for yourself to help you narrow down the list and focus on finding a great financial advisor for you. Finding an investment advisor who is right for you is a critical financial decision, and it can be complicated. There are many variables that should be. How many names do you know in the finance industry? There are probably just a handful! When it comes to choosing a financial advisor, you want to be. Many believe that financial advisors are only for those with lots of money to invest. The truth is that working with an advisor is a great choice for anyone. To help consumers select a financial advisor and protect themselves from questionable or predatory practices. Many advisors are actually commissioned. Ask for the Financial Services Guide · the services they are authorised to offer and the product areas they can advise on — you can check this on the financial. Selecting the Right Wealth Management Firm · What type of services does your firm offer beyond investment management and financial planning? These may include. 1. Realized financial returns are a factor in your investment earnings and the taxes you pay on those returns. 2. Likability and comfort with your advisor. Looking for a financial advisor? Learn how to identify the title and credentials of an advisor who must place your needs ahead of their own. Free download. A good adviser should be able to advise you on any big financial decision in addition to managing the details of your portfolio. If you have a more specialized. Financial planners and advisors typically provide retirement planning, college planning, estate planning and sometimes tax planning. 1. What are your qualifications and credentials? · 2. How will I pay for your services? · 3. What types of investments and financial services do you offer? · 4. Here are suggestions for figuring out when you might want to seek advice, what kind of advice you may need, how to choose the right financial advisor and what. How to Choose a Financial Advisor Distinguishing among so many people claiming to be financial planners, financial advisors, financial counselors.

1 2 3 4 5 6